Supplies Expense Vs Supplies . office expenses and supplies are often used interchangeably, but they actually refer to two different things. a few key differences between office expenses vs supplies are essential regarding taxes. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. Depending on the type of business,. How do you know whether an expense should be considered an office. Computers, smartphones, are considered assets and can be depreciated. office supplies are usually considered an expense. But things can get tricky when dealing with office supplies,. supplies expense refers to the cost of consumables used during a reporting period. however, higher priced office expenses, e.g. office supplies vs.

from accountingqanda.blogspot.com

Computers, smartphones, are considered assets and can be depreciated. supplies expense refers to the cost of consumables used during a reporting period. But things can get tricky when dealing with office supplies,. however, higher priced office expenses, e.g. a few key differences between office expenses vs supplies are essential regarding taxes. office expenses and supplies are often used interchangeably, but they actually refer to two different things. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. office supplies vs. Depending on the type of business,. office supplies are usually considered an expense.

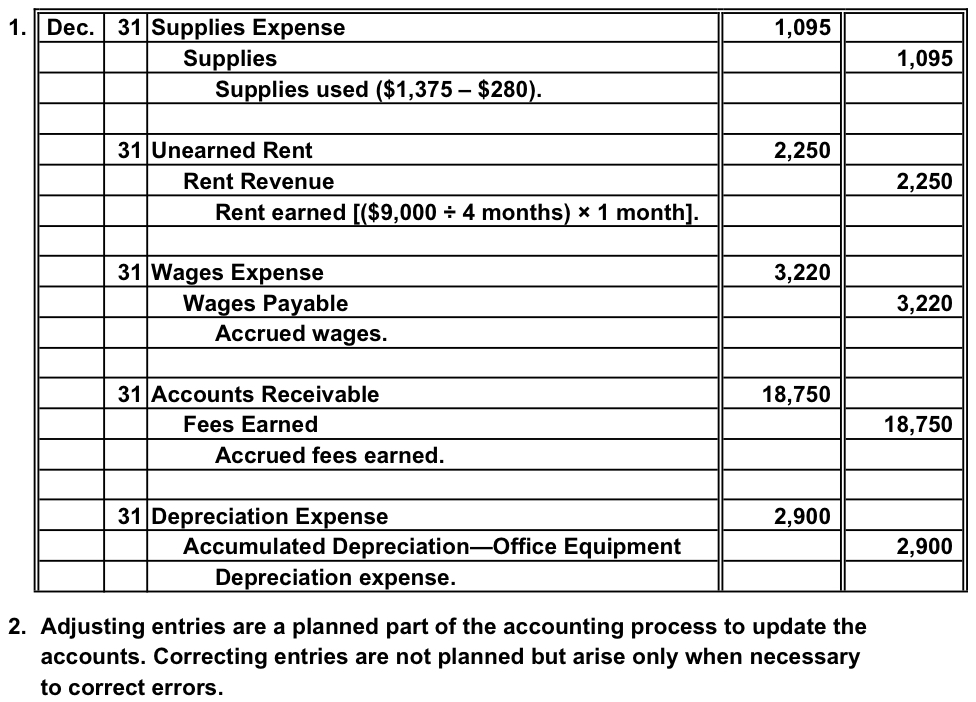

Accounting Questions and Answers PR 31A Adjusting entries

Supplies Expense Vs Supplies understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. a few key differences between office expenses vs supplies are essential regarding taxes. supplies expense refers to the cost of consumables used during a reporting period. How do you know whether an expense should be considered an office. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. But things can get tricky when dealing with office supplies,. however, higher priced office expenses, e.g. Computers, smartphones, are considered assets and can be depreciated. Depending on the type of business,. office supplies are usually considered an expense. office expenses and supplies are often used interchangeably, but they actually refer to two different things. office supplies vs.

From www.superfastcpa.com

What is Supplies Expense? Supplies Expense Vs Supplies office supplies vs. however, higher priced office expenses, e.g. office expenses and supplies are often used interchangeably, but they actually refer to two different things. But things can get tricky when dealing with office supplies,. Depending on the type of business,. How do you know whether an expense should be considered an office. a few key. Supplies Expense Vs Supplies.

From easemybrain.com

Office Expenses Vs Supplies What Are The Differences? Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. supplies expense refers to the cost of consumables used during a reporting period. How do you know whether an expense should be considered an office. office supplies vs. however, higher priced office expenses, e.g. Depending on the type of business,. But things can. Supplies Expense Vs Supplies.

From accountingqanda.blogspot.com

Accounting Questions and Answers PR 31A Adjusting entries Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. however, higher priced office expenses, e.g. office supplies vs. But things can get tricky when dealing with office supplies,. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. supplies expense refers to the cost. Supplies Expense Vs Supplies.

From www.pdffiller.com

Fillable Online Office expenses vs. supplies What's the difference Supplies Expense Vs Supplies office supplies vs. however, higher priced office expenses, e.g. office expenses and supplies are often used interchangeably, but they actually refer to two different things. supplies expense refers to the cost of consumables used during a reporting period. a few key differences between office expenses vs supplies are essential regarding taxes. But things can get. Supplies Expense Vs Supplies.

From flyfin.tax

Are Office Supplies Tax Deductible For The SelfEmployed? Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. office expenses and supplies are often used interchangeably, but they actually refer to two different things. How do you know whether an expense should be considered an office. understanding the distinction between office expenses and supplies is crucial for effective financial management within any. Supplies Expense Vs Supplies.

From www.akounto.com

Are Supplies an Asset? Understand with Examples Akounto Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. office supplies are usually considered an expense. however, higher priced office expenses, e.g. office supplies vs. How do you know whether an expense should be considered an office. Depending on the type of business,. supplies expense refers to the cost of consumables. Supplies Expense Vs Supplies.

From biz.libretexts.org

5.1 Describe and Prepare Closing Entries for a Business Business Supplies Expense Vs Supplies office supplies vs. however, higher priced office expenses, e.g. Depending on the type of business,. How do you know whether an expense should be considered an office. supplies expense refers to the cost of consumables used during a reporting period. office expenses and supplies are often used interchangeably, but they actually refer to two different things.. Supplies Expense Vs Supplies.

From www.patriotsoftware.com

Cost of Goods Sold vs. Operating Expenses Complete Guide Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. office expenses and supplies are often used interchangeably, but they actually refer to two different things. however, higher priced office expenses, e.g. How do you know whether an expense should be considered an office. Computers, smartphones, are considered assets and can be depreciated. . Supplies Expense Vs Supplies.

From www.myaccountingcourse.com

What is Selling, General & Administrative Expense (SG&A)? Definition Supplies Expense Vs Supplies Depending on the type of business,. office supplies are usually considered an expense. a few key differences between office expenses vs supplies are essential regarding taxes. office supplies vs. Computers, smartphones, are considered assets and can be depreciated. How do you know whether an expense should be considered an office. But things can get tricky when dealing. Supplies Expense Vs Supplies.

From www.pinterest.com

Office expenses vs. supplies What’s the difference? Expensive Supplies Expense Vs Supplies office supplies vs. a few key differences between office expenses vs supplies are essential regarding taxes. How do you know whether an expense should be considered an office. supplies expense refers to the cost of consumables used during a reporting period. Computers, smartphones, are considered assets and can be depreciated. understanding the distinction between office expenses. Supplies Expense Vs Supplies.

From www.chegg.com

Solved Revenue 2000000 Expenses Salaries Expense supplies Supplies Expense Vs Supplies a few key differences between office expenses vs supplies are essential regarding taxes. office supplies vs. Depending on the type of business,. office expenses and supplies are often used interchangeably, but they actually refer to two different things. supplies expense refers to the cost of consumables used during a reporting period. But things can get tricky. Supplies Expense Vs Supplies.

From www.pinterest.com

Schedule C Office Expenses vs. Supplies Supplies, Bookkeeping, Schedule Supplies Expense Vs Supplies Computers, smartphones, are considered assets and can be depreciated. Depending on the type of business,. But things can get tricky when dealing with office supplies,. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. office supplies vs. however, higher priced office expenses, e.g. supplies expense refers to the. Supplies Expense Vs Supplies.

From www.elearnmarkets.com

Demand and Supply Understanding its Relationship Supplies Expense Vs Supplies Depending on the type of business,. office supplies are usually considered an expense. supplies expense refers to the cost of consumables used during a reporting period. office supplies vs. How do you know whether an expense should be considered an office. office expenses and supplies are often used interchangeably, but they actually refer to two different. Supplies Expense Vs Supplies.

From www.quill.com

Office expenses vs. supplies What’s the difference? Quill Blog Supplies Expense Vs Supplies But things can get tricky when dealing with office supplies,. How do you know whether an expense should be considered an office. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. a few key differences between office expenses vs supplies are essential regarding taxes. supplies expense refers to the. Supplies Expense Vs Supplies.

From suppliesmatobitsu.blogspot.com

Supplies Supplies Expense Supplies Expense Vs Supplies however, higher priced office expenses, e.g. But things can get tricky when dealing with office supplies,. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. office supplies vs. Computers, smartphones, are considered assets and can be depreciated. office expenses and supplies are often used interchangeably, but they actually. Supplies Expense Vs Supplies.

From wealthnation.io

How to Balance Fixed Expenses with Variable Costs Wealth Nation Supplies Expense Vs Supplies Depending on the type of business,. Computers, smartphones, are considered assets and can be depreciated. supplies expense refers to the cost of consumables used during a reporting period. How do you know whether an expense should be considered an office. office supplies vs. office supplies are usually considered an expense. however, higher priced office expenses, e.g.. Supplies Expense Vs Supplies.

From www.slideteam.net

Office Supplies Vs Office Expense Ppt Powerpoint Presentation Gallery Supplies Expense Vs Supplies however, higher priced office expenses, e.g. understanding the distinction between office expenses and supplies is crucial for effective financial management within any business. How do you know whether an expense should be considered an office. supplies expense refers to the cost of consumables used during a reporting period. office supplies are usually considered an expense. . Supplies Expense Vs Supplies.

From swenbew.com

Office Supplies vs. Office Expense vs. Office Equipment What's the Supplies Expense Vs Supplies office supplies are usually considered an expense. Computers, smartphones, are considered assets and can be depreciated. however, higher priced office expenses, e.g. How do you know whether an expense should be considered an office. supplies expense refers to the cost of consumables used during a reporting period. understanding the distinction between office expenses and supplies is. Supplies Expense Vs Supplies.